Hello entrepreneurs!

So, you've started your business (congrats, by the way!) and you've heard the term “margin” floating around. It's thrown in business chats, whispered in the hallways of conventions, and sometimes even scribbled on the back of napkins at coffee shops. But what does it really mean? And why should you, a bustling business owner, even care?

Why 'Margin' Matters

Before diving into the nitty-gritty, let’s address the elephant in the room: What's margin, and why should you give a hoot? Simply put, margin represents the difference between the selling price of your product and its cost. Think of it as the profit you're left with after accounting for production expenses. Why's this golden? Because understanding your margin is vital for:

Now, who wouldn't want that, right?

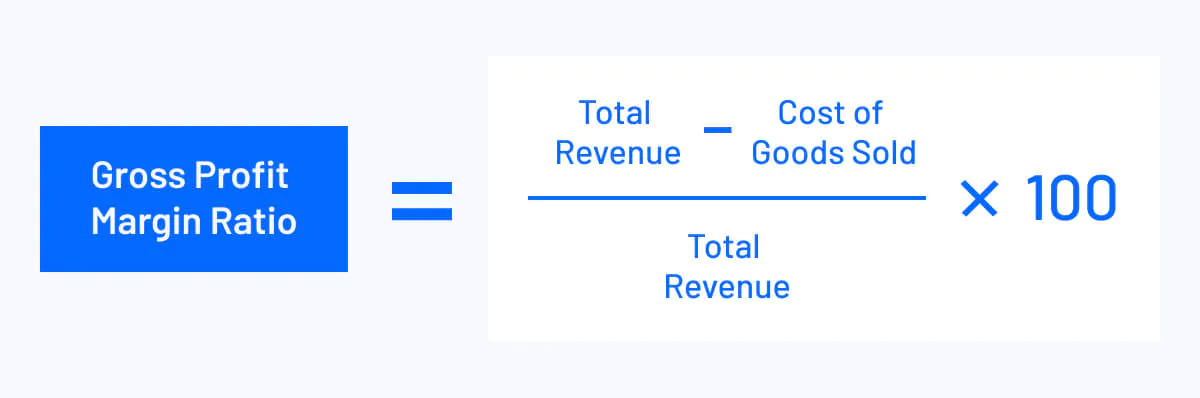

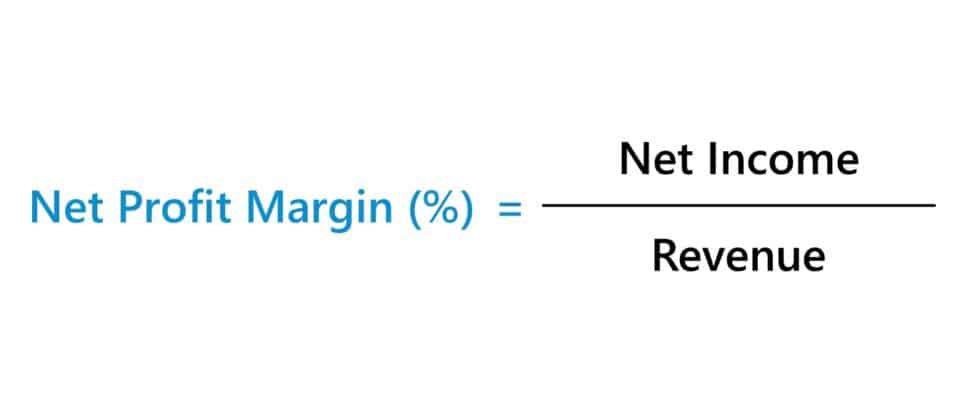

Breaking It Down: Gross Margin vs. Net Margin

Let's kick things off with two biggies: Gross Margin and Net Margin. Sounds fancy, right? But let's untangle these terms.

Crunching the Numbers: Calculate Your Margin

Here’s where the rubber meets the road. Calculating margin isn’t rocket science, promise!

Wrap-up & Action Steps

Understanding and calculating your margin isn't just a numbers game; it's a strategy game. It's about knowing where your money is coming from, where it's going, and most importantly, how you can make more of it without working harder.

Here's what you can do next:

Remember, as a business owner, you're not just in the game to play; you're in it to win. And understanding your margin is a key player in that victory lap.

K7 Leadership

(619) 249-8121

[email protected]

© 2022 K7 Leadership. All Rights Reserved.