Hello entrepreneurs!

So, you've started your business (congrats, by the way!) and you've heard the term “margin” floating around. It's thrown in business chats, whispered in the hallways of conventions, and sometimes even scribbled on the back of napkins at coffee shops. But what does it really mean? And why should you, a bustling business owner, even care?

Why 'Margin' Matters

Before diving into the nitty-gritty, let’s address the elephant in the room: What's margin, and why should you give a hoot? Simply put, margin represents the difference between the selling price of your product and its cost. Think of it as the profit you're left with after accounting for production expenses. Why's this golden? Because understanding your margin is vital for:

Now, who wouldn't want that, right?

Breaking It Down: Gross Margin vs. Net Margin

Let's kick things off with two biggies: Gross Margin and Net Margin. Sounds fancy, right? But let's untangle these terms.

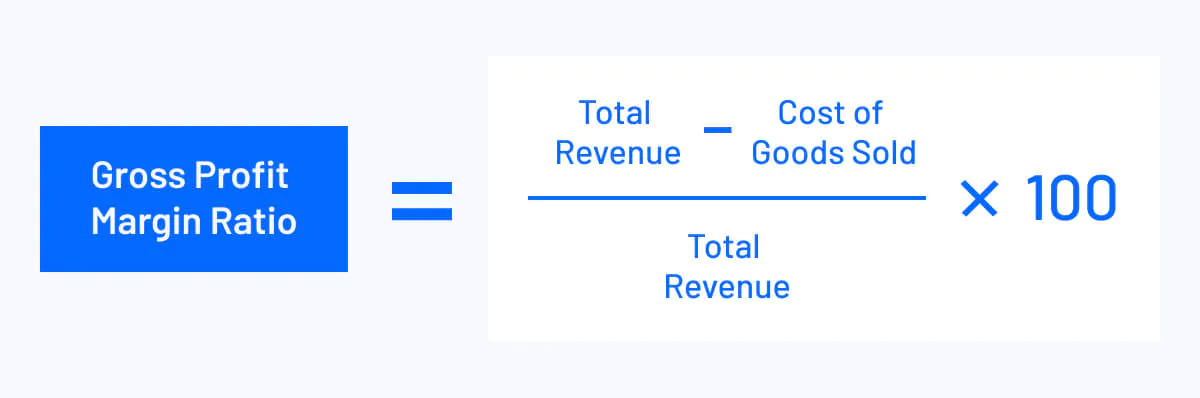

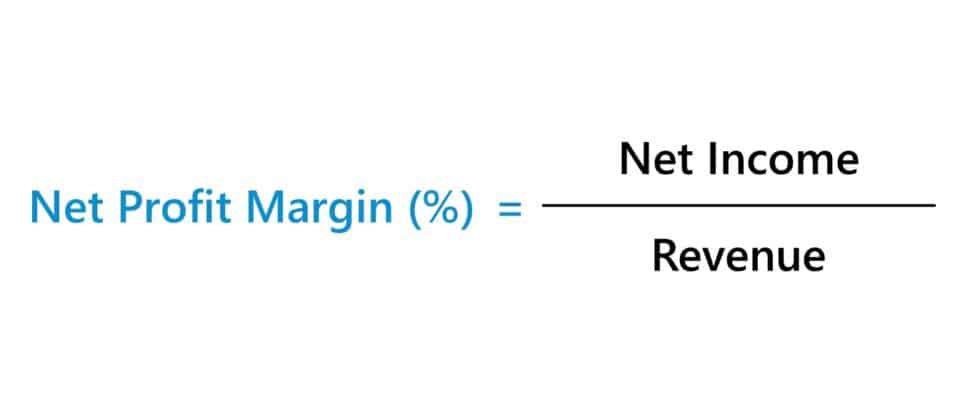

Crunching the Numbers: Calculate Your Margin

Here’s where the rubber meets the road. Calculating margin isn’t rocket science, promise!

Wrap-up & Action Steps

Understanding and calculating your margin isn't just a numbers game; it's a strategy game. It's about knowing where your money is coming from, where it's going, and most importantly, how you can make more of it without working harder.

Here's what you can do next:

Remember, as a business owner, you're not just in the game to play; you're in it to win. And understanding your margin is a key player in that victory lap.

The collapse of Silicon Valley Bank last week serves as an important reminder to Managed Services Providers (MSPs) that no amount of wealth or growth can protect them from the ultimate risk – keeping their customers happy and well-serviced. Now a full week later, it’s time to take a look back at this shock wave and discuss what MSPs can learn - not only about managing risks but also how they can build stronger customer relationships by adhering even more tightly to the values that underpin successful businesses. As an MSP owner looking to create maximum customer service excellence and ongoing value for your customer base, you should consider taking heed of some of these lessons if you wish to remain competitive in today's fast-paced world.

In the year 2021, when near-zero interest rates prevailed, Silicon Valley Bank invested an incredible $90 billion of its customers' deposits in bonds. In 2022, the Federal Reserve began to elevate interest rates to manage inflation and achieved 4% by year's end. It's important to recall that bond prices usually fluctuate counter-intuitively with changes in interest rates - which is why Silicon Valley Bank experienced declining bond values as this increase occurred.

On Wednesday, Silicon Valley Bank declared that their bonds brought in losses and required more wealth to support customer deposits. As customers grew increasingly concerned with the bank's stability, they started withdrawing funds at an alarming rate - a phenomenon known as a 'bank run'. By Thursday night, withdrawal requests had climbed up to $42 billion - far surpassing what the institution could manage. To address the alarm caused by ballooning losses, the FDIC swiftly took control of Silicon Valley Bank.

As MSP owners, it is paramount to comprehend the extensive landscape of cybersecurity risks and be armed with suitable precautions against them. We face risk from all corners - customers, workers, or partners within our industry - so we must take every precaution necessary to safeguard our businesses.

Safeguarding the risk that our employees and solutions pose to our services is the simplest way to ensure safety. And why not? There are plenty of knowledgeable, resourceful folks like Wes Spencer from Empath Cyber and Fifthwall Insurance who can provide effective training for your team as well as insurance policies for unforeseen circumstances.

But what about on your client side? During COVID-19 I was fortunate enough to work with many MSP owners who struggled greatly because their clients simply could not pay for their services. So much so that MSPs that chose to go after hospitality verticals had no cash flow to speak of; unfortunately causing one MSP to go out of business.

What set the successful businesses apart? They kept their free cash flow under control. Free cash flow (FCF) is a company's leftover money after accounting for all of its operating expenses and capital expenditures, also known as OpEx and CapEx respectively. Essentially, it is the money that remains once a business has Settled all of its costs to keep running. When managed effectively, FCF can be one of the most powerful tools in any company’s arsenal.

Put simply, successful MSPs have adequate free cash flow and resources on-hand to weather the storm when their clients' spending drops. Still not clear enough? It's like this: if your customers don't pay you, you must still have enough money in the reserve to cover your operational costs. Some established financial advisers recommend having 2-3 months of accessible funds available for any business that wants guaranteed protection against a troublesome month.

As Managed Service Providers, our largest expenditure is for labor. To illustrate, a full-time employee earning $75,000 will cost around $93,750 after taking into account taxes and other fees; that's equivalent to almost eight thousand dollars each month! Therefore if we have four employees and want 2 months of savings in the event all income disappears altogether, then we would need approximately $46,875.

Gone are the days where we thought "that will never happen." Amidst pandemics and looming economic downturns, it is paramount to fortify our business if we want to sail through any trial. This is why I encourage you to turn your attention toward FCF—a tool that can be used to commence growing a monetary cushion. Use your budget and prediction to start preparing for improved Gross Margin numbers which could result in more favorable Net Profit results. Allocate a definite amount of your FCF each month to an emergency fund. It may seem like you're contributing meagerly, but with consistent investment and accountability, in just 9-12 months, you can save up at least one month's worth or more.

Most notably, this tactic enhances fiscal sustainability which is essential to assess the value of your managed service provider (MSP). It's ideal when you intend to seek debt financing or eventually sell off your business. Furthermore, it can also be incorporated into purchasing strategies so that you ensure maximum savings.

Ensuring that Silicon Valley Bank failed to comprehend its operating expenditure requirements and the debt it owed to clients, it ultimately collapsed as it took on more risk by investing its cash reserve into long-term notes. Had they been more thoughtful in assessing their business needs, this downfall could have been prevented from making headlines throughout the nation. Thus, let us MSPs take our time formulating efficient processes so we can surmount any tribulations that may arise.

As an MSP, having a strong free cash flow is the key to staying afloat and weathering any storm. By taking proactive steps such as budgeting and predicting gross margin numbers, you can build up your reserves so that when times get tough, you have something to fall back on. If you want help creating strategies like these for your business or need assistance in assessing how much money should be allocated towards emergency funds each month, don't hesitate to reach out!

Schedule a call with K7 leadership today and let's talk about ways we can work together to make sure your business exceeds expectations and grows faster than you ever thought possible!

K7 Leadership

(619) 249-8121

[email protected]

© 2022 K7 Leadership. All Rights Reserved.