The collapse of Silicon Valley Bank last week serves as an important reminder to Managed Services Providers (MSPs) that no amount of wealth or growth can protect them from the ultimate risk – keeping their customers happy and well-serviced. Now a full week later, it’s time to take a look back at this shock wave and discuss what MSPs can learn - not only about managing risks but also how they can build stronger customer relationships by adhering even more tightly to the values that underpin successful businesses. As an MSP owner looking to create maximum customer service excellence and ongoing value for your customer base, you should consider taking heed of some of these lessons if you wish to remain competitive in today's fast-paced world.

In the year 2021, when near-zero interest rates prevailed, Silicon Valley Bank invested an incredible $90 billion of its customers' deposits in bonds. In 2022, the Federal Reserve began to elevate interest rates to manage inflation and achieved 4% by year's end. It's important to recall that bond prices usually fluctuate counter-intuitively with changes in interest rates - which is why Silicon Valley Bank experienced declining bond values as this increase occurred.

On Wednesday, Silicon Valley Bank declared that their bonds brought in losses and required more wealth to support customer deposits. As customers grew increasingly concerned with the bank's stability, they started withdrawing funds at an alarming rate - a phenomenon known as a 'bank run'. By Thursday night, withdrawal requests had climbed up to $42 billion - far surpassing what the institution could manage. To address the alarm caused by ballooning losses, the FDIC swiftly took control of Silicon Valley Bank.

As MSP owners, it is paramount to comprehend the extensive landscape of cybersecurity risks and be armed with suitable precautions against them. We face risk from all corners - customers, workers, or partners within our industry - so we must take every precaution necessary to safeguard our businesses.

Safeguarding the risk that our employees and solutions pose to our services is the simplest way to ensure safety. And why not? There are plenty of knowledgeable, resourceful folks like Wes Spencer from Empath Cyber and Fifthwall Insurance who can provide effective training for your team as well as insurance policies for unforeseen circumstances.

But what about on your client side? During COVID-19 I was fortunate enough to work with many MSP owners who struggled greatly because their clients simply could not pay for their services. So much so that MSPs that chose to go after hospitality verticals had no cash flow to speak of; unfortunately causing one MSP to go out of business.

What set the successful businesses apart? They kept their free cash flow under control. Free cash flow (FCF) is a company's leftover money after accounting for all of its operating expenses and capital expenditures, also known as OpEx and CapEx respectively. Essentially, it is the money that remains once a business has Settled all of its costs to keep running. When managed effectively, FCF can be one of the most powerful tools in any company’s arsenal.

Put simply, successful MSPs have adequate free cash flow and resources on-hand to weather the storm when their clients' spending drops. Still not clear enough? It's like this: if your customers don't pay you, you must still have enough money in the reserve to cover your operational costs. Some established financial advisers recommend having 2-3 months of accessible funds available for any business that wants guaranteed protection against a troublesome month.

As Managed Service Providers, our largest expenditure is for labor. To illustrate, a full-time employee earning $75,000 will cost around $93,750 after taking into account taxes and other fees; that's equivalent to almost eight thousand dollars each month! Therefore if we have four employees and want 2 months of savings in the event all income disappears altogether, then we would need approximately $46,875.

Gone are the days where we thought "that will never happen." Amidst pandemics and looming economic downturns, it is paramount to fortify our business if we want to sail through any trial. This is why I encourage you to turn your attention toward FCF—a tool that can be used to commence growing a monetary cushion. Use your budget and prediction to start preparing for improved Gross Margin numbers which could result in more favorable Net Profit results. Allocate a definite amount of your FCF each month to an emergency fund. It may seem like you're contributing meagerly, but with consistent investment and accountability, in just 9-12 months, you can save up at least one month's worth or more.

Most notably, this tactic enhances fiscal sustainability which is essential to assess the value of your managed service provider (MSP). It's ideal when you intend to seek debt financing or eventually sell off your business. Furthermore, it can also be incorporated into purchasing strategies so that you ensure maximum savings.

Ensuring that Silicon Valley Bank failed to comprehend its operating expenditure requirements and the debt it owed to clients, it ultimately collapsed as it took on more risk by investing its cash reserve into long-term notes. Had they been more thoughtful in assessing their business needs, this downfall could have been prevented from making headlines throughout the nation. Thus, let us MSPs take our time formulating efficient processes so we can surmount any tribulations that may arise.

As an MSP, having a strong free cash flow is the key to staying afloat and weathering any storm. By taking proactive steps such as budgeting and predicting gross margin numbers, you can build up your reserves so that when times get tough, you have something to fall back on. If you want help creating strategies like these for your business or need assistance in assessing how much money should be allocated towards emergency funds each month, don't hesitate to reach out!

Schedule a call with K7 leadership today and let's talk about ways we can work together to make sure your business exceeds expectations and grows faster than you ever thought possible!

In these difficult times, many businesses are struggling to stay afloat. However, there are some companies that are thriving even in the midst of a recession. Managed services providers (MSPs) have the potential to excel during tough economic times by providing essential services to businesses that need to cut costs. By understanding the challenges that businesses face during a recession and tailoring their services accordingly, MSPs can position themselves for success. In this blog post, we'll explore how MSPs can achieved success in a downturn economy.

To become a successful managed services provider in an economic downturn, it is essential to take a laser-focused approach to defining your niche and target market. Knowing who you can provide value to and what their needs are is the key to success. Ask yourself: who are the people and businesses most affected by this recession? How can I provide them with the services they need? Once you have identified your niche and target market, you can craft a strategy for delivering your services efficiently and effectively - giving them reliable solutions amidst unstable times. Preparation is key - so be sure to do your research, identify your target market, and create a plan for ensuring their success.

Professional services are increasingly essential in a digital economy, yet companies fear that their budgets may be too tight to invest in innovative and quality solutions. Managed services providers can offer clients peace of mind by emphasizing the value they bring over cost savings alone - demonstrating a long-term commitment to added expertise, insight and experience that goes beyond simply providing a low price option. Developing a comprehensive marketing plan that showcases these additional benefits helps managed services providers maintain success even during times of economic downturn, setting them apart from the competition and underlining their capacity for innovation when it is most needed.

Focusing on effective and consistent service delivery has never been more important than it is now, as businesses must make smart decisions to weather the storm of a downturn economy. Managed service providers who can deliver effective solutions for their clients that exceed expectations not only come out ahead of competitors, but build long-term relationships with those clients. Now is the time to focus on quality - effective strategies, consistent customer engagement and unparalleled customer support - to ensure success in the short and long term in a difficult economic climate.

In tumultuous economic times, the relationships you create and nurture with clients can be the difference between weathering storms, or getting lost in the rough seas. Managed Service Providers who understand how important building these kinds of relationships can be stand a better chance of achieving success - particularly when economic times are hard. Invest in learning more about each individual client, their needs and goals, and use this information to provide relevant insights that benefit them. By showing that you care about your customers’ wellbeing above all else - despite the state of the economy - they are more likely to stay loyal and stick with services for the long term.

As a managed services provider, especially during a downturn in the economy, it's important to stay agile and be open to making adjustments and trying new things. Don't be afraid to reassess what your services are and explore how you can adjust them to fit the changing needs of your customers. Changing with the times ensures that your customers remain satisfied and that you have stability in spite of economic uncertainty - ultimately yielding success as an MSP. Cheers to staying ahead of the curve!

The economic downturn we are currently experiencing is an opportunity for managed service providers to succeed. The key to success is to define your niche and target market, create a marketing plan that focuses on value over price, focus on delivering quality service, build strong relationships with your clients, and be prepared to adapt and change as the economy shifts. With these principles in mind, managed service providers can have their best year yet by taking advantage of the current uncertainty.

We invite you to take advantage of our free download, “The 2023 Workbook” which all K7 Leadership clients use to help grow their business in ANY times. Use this free guide as a starting point to capture the opportunity presented by today’s uncertain times. Create something great by acting boldly and never stop striving for success.

Best part, no sign up! Download today

Need more help? Schedule time with us to work through this exercise with your team. In 90 minutes we'll show you the tools to get you to reach your goals.

Peculiar, right? My old man said something like this to me for days on end and it's stuck. I'd also be remised to not say that it has bitten me in the ass from time to time in my quest for perfection. So when faced with the other adage of "perfection is the enemy of progress", I find myself at a crossroads in combating the damnation of my programming. What's interesting, and the premise of this article is that every year in Q4 we have a chance to change our expectations for the upcoming year. Even more, we can look back on the year prior and set new goals with intention. And that's precisely the word I want to zoom in on--intention (and its required attention) separates those who plan from those who simply react.

Here is an easy test for you, ask yourself one of these questions:

If you were unsure of what the goal was back in January, or if you're unable to honestly state that you've achieved it (or maybe you simply didn't), your aim may have been beyond your current maturity.

Sometimes, as owners, we lose track of what's important and make goals that are impossible to achieve or aren't well-defined. If you have colleagues or a group of peers, this is an excellent opportunity to set some achievable objectives for the upcoming year. You might also receive helpful feedback about whether your proposed goals will be too demanding for your team and push them too hard--perhaps even to the point of burnout.

That being said, goals that are too easy or impossible may hurt team morale. So think carefully about where you need to be!

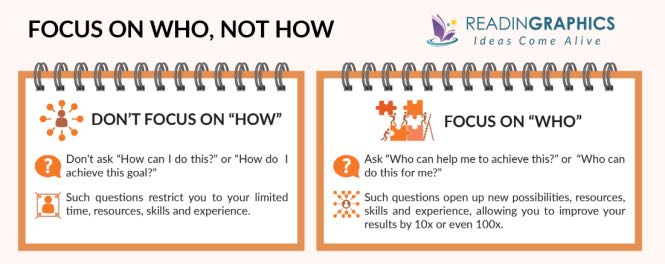

Next year's objectives will be influenced by several variables, including sales increases, decreased workloads, and the possibility of new services. In most cases, these objectives will need the input of several team members. Regardless of how things are done in the process, it's crucial to know WHO.

Who Not How is a good book that explains this idea through the use of software like Scrum and discusses why focusing too much on how something will get done might stifle development since it would consume leadership teams' time where they could have been concentrating on more essential activities.

How does this relate to accountability? It's quite simple: for each goal on your business plan, designate one person who will be held responsible for achieving it by the end of the year. refrain from assigning how they will go about doing so.

It's no surprise, but it is still remarkable to me how many small businesses do not yet have a formal Budget or Quota generation process. This is the single most important thing you can do to guarantee that your company grows at the expected rate, that your objectives are feasible, and that any new initiatives will have enough financial backing.

Knowing your sales targets and budgets for the year is important for you and your leadership team to hold each other accountable and make smart decisions with company finances. If unanticipated costs pop up or sales are lower than expected, being proactive and having a plan lets you adapt quickly instead of scrambling later on. And because we're looking ahead intentionally, setting budgets helps manage cash flow so you're ready when it's time to make a big purchase or investment.

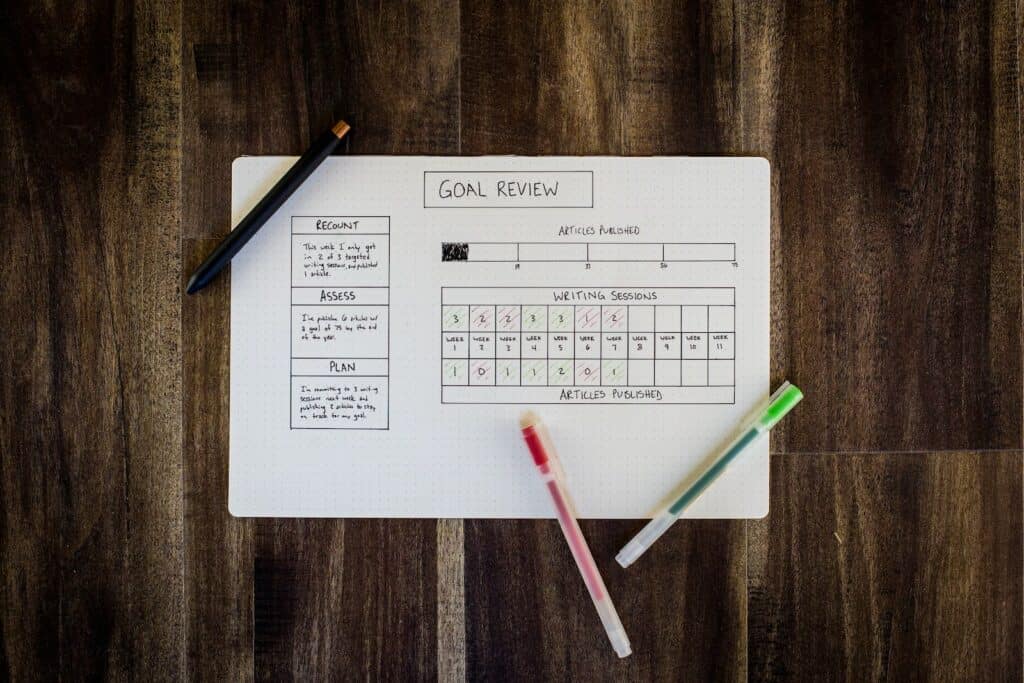

Use visuals in your business plan as often as possible, but not excessively. Graphs, charts, and pictures can assist you bring your idea to life. It also helps the text flow more easily because it breaks up the content.

Look towards the future, before anything else on this list. To be a great visionary leader you must look 3-5 years in advance and decide where you want your company to be. Doing so, will help better plan and guide next year's vision.

I intentionally placed this at the bottom of the list! Why? Because to lead effectively, you must be disciplined--and that's harder than just reading an article. When you set a 5-year goal (or even more complicated ones like 7-10 year goals) for your team, you have to work hard to keep everyone motivated so that progress doesn't stall. This entails determining yearly what smaller goals are necessary to accomplish the larger one.

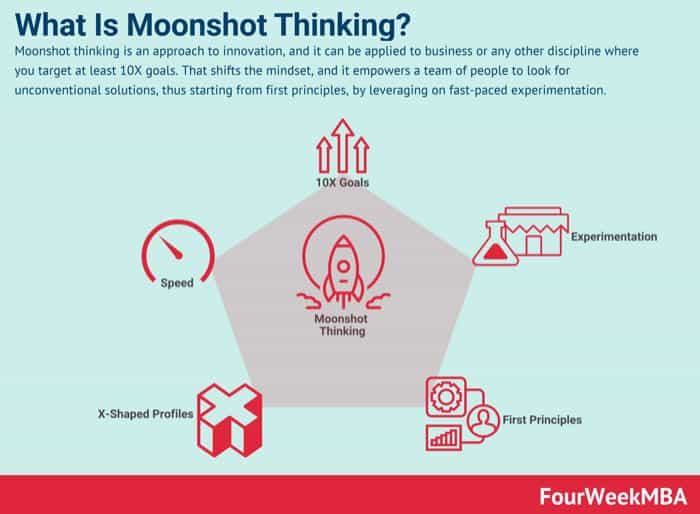

Jim Collins wrote a great book called "Built to Last: Successful Habits of Visionary Companies" that calls these BHAGs, or Big Hairy Audacious Goals. In his words, "A BHAG is a powerful way to stimulate progress. A BHAG is clear and compelling, needing little explanation; people get it right away. Think of the NASA moon mission of the 1960s. The best BHAGs require both buildings for the long term AND exuding a relentless sense of urgency: What do we need to do today, with monomaniacal focus, and tomorrow, and the next day, to defy the probabilities and ultimately achieve our BHAG?"

Creating an intentional business strategy for 2023 can seem daunting, but it's important to have a plan if you want your business to grow at the expected rate. The steps we've outlined include creating a budget and quota, designating someone responsible for each goal, and using visuals to help explain your ideas. Most importantly, don't forget to look forward and set long-term goals for your company. These goals will provide direction and motivation as you work towards accomplishing them

Now that you know how to create an intentional business strategy for 2023, it's time to get started! Follow the steps we've outlined and make sure to stay motivated by keeping your long-term goals in mind. Let us know how it goes in the comments below. If you want assistance, there is a worksheet available for you to get started and a scheduling link that will set up a free consultation to assist you with starting or improving your Business Plan.

Most of us have heard about Aerosmith, one of the most iconic bands in music history.

The band has quite a few rituals – some pre-show, some post-show, and others revolving around the music they create. Among these, there is a particularly interesting one.

At the band's weekly meeting, every member presents a new idea regardless of how silly or embarrassing they think it is. Oftentimes, the ideas put forward are complete rubbish and end up getting rejected immediately.

Although it's rare, every so often an idea comes along that makes everyone go 'You know what? This could work!' Some of their most famous songs, such as ‘Love in an Elevator' and ‘Dude Looks Like a Lady,’ were inspired by these meetings.

They call this weekly meeting ‘Dare to Suck‘.

Ed Sheeran, who is considered by many to be one of the best songwriters today, has a very simple process for writing songs. He simply writes down everything that comes into his head. The beginning may not be too great, but soon enough it starts to get good - almost as if someone has flipped a switch. Neil Gaiman (a #1 New York Times bestselling author of more than 20 books) talks about a very similar process in his Masterclass.

Many of the world's greatest creative minds produce their best work by following a similar pattern: they let all their ideas flow out without judging or critiquing them. At first, the ideas are fuzzy, weak, and bad according to their standards. Once these "impurities" have been flushed, periods of intense creativity and genius often follow.

We often produce subpar work because we don't let our minds clear before starting. This occurs in many scenarios; an important presentation, creating marketing content, or the desire to learn something new. If we embrace our bad ideas and allow the fog to lift, we can uncover our brilliance.

Oftentimes, we refrain from starting new projects because we doubt the quality of our ideas; our forms of Imposter Syndrome. Instead of developing them further by sharing them with others, or writing them down to explore our thoughts more fully, we keep them locked up as an excuse for procrastination.

Next time you have an idea for something, start by jotting down every thought you have about it, without filtering or censoring yourself. Remember that even the most brilliant diamonds are found buried in the rough. So remove all distractions and turn off your inner critic; just let the ideas flow freely onto the page.

Keep this up regularly and see if you eventually reach the point where fresh ideas start bubbling out. I'm certain you'll get there quicker than you expect! You'll come up with thoughts that were hidden in some dark recess of your mind that you didn't know existed. In other words, another side of yourself will be revealed because we all have those imaginative ideas within us somewhere, buried below everything else we take in from the world around us each second of every day.

Yes lives in a sea of No. Failure is just a lesson on the path to success. Rome wasn't built in a day.

Just Dare to suck.

Business coaching services are an essential tool for any small business owner looking to improve their business. If you're a small business owner, consider using business coaching services to help you overcome hurdles and grow your business more efficiently. A coach can offer expert advice and guidance that can make a big difference in your success. Having a business coach is an important step in taking your business to the next level.

It's clear that business coaching services can be extremely beneficial for small business owners. If you're looking to improve your business, consider using a coach to help you achieve your goals. A coach can offer expert advice and guidance that can make a big difference in your success. Business coaching services are an essential tool for any small business owner looking to improve their business.

Do you want to know if there are any problems in your company that a Business Coach could help you identify? If this is the case, you're not alone! Many company owners get overwhelmed by their businesses at times, and a Business Coach can provide an unbiased perspective and point out any structural issues.

For example, if you're facing difficulty growing your business, a Business Coach can help pinpoint the areas you need to focus on. With their help, you can develop a plan to overcome these obstacles and continue to propel your business forward.

If you're looking to improve accountability in your business, a business coach can be a huge help. They can keep you on track with your priorities and give you feedback on your progress. This feedback is essential for knowing how well you're doing and whether you need to make any adjustments. With a business coach by your side, you'll be able to achieve greater accountability and growth in your business.

If you're a business owner who is looking to grow and expand your business, working with a business coach can be a great way to achieve this. Business coaches can provide tailored recommendations and guidance to help you overcome any roadblocks you may be facing. They can help you with strategic planning, leadership development, and operational maturity - things that smaller businesses often have difficulty with.

If you're like most people, your brain is a bit of a mess. We've all heard the adage that "two heads are better than one." This is an excellent idea. Whether you're running new marketing initiatives, sales methods, management skills, or changes to enhance your operations, the ideas will always be better if they go through an expert.

If you still have doubts, consider this: if you were a fantastic singer (or parent of one) with goals, wouldn't you want as much assistance as possible? You also need to understand that there are no shortcuts; it takes hard work and dedication. If you take the time to explore all options in-depth (and learn how to recognize proper ones when they appear), your chances of finding something suitable increase dramatically.

Business coaching can help you take your business to the next level. A good coach will have vast expertise and knowledge in a variety of areas and can provide you with invaluable insight and guidance. As the old saying goes, “none of us are as smart as all of us.” By working with a coach, you can benefit from the collective wisdom and experience of a team of professionals.

A small business coach or executive coach – with a coaching certification – who has loads of experience is the best teacher you can get. It does not matter if you are new to the industry or have been around for a while, or whether it’s an average market day or during an economic crisis, a small business coach will always help push your company towards success. Coaches will make you think critically, provide solutions when needed, and be by your side as you achieve greatness.

If you're looking for help growing your business, a business coach can be a great investment. They can provide tailored recommendations and guidance to help you overcome any roadblocks you may be facing. To find out more about how a business coach can help you achieve greater accountability and growth in your business, contact us today. We would be happy to answer any of your questions and discuss how we can help you take your company to the next level.

K7 Leadership

(619) 249-8121

[email protected]

© 2022 K7 Leadership. All Rights Reserved.